PISTOL BAY OPTIONS ADDITIONAL CLAIMS IN RED LAKE, ONTARIO

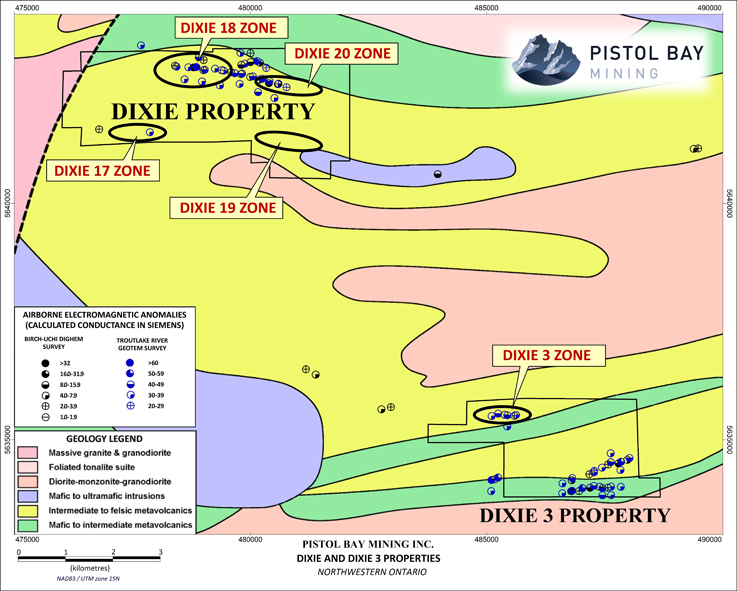

September 1, 2016:Pistol Bay Mining Inc. (TSX-V - PST; Frankfurt - OQS2) (the “Company’) reports that it has executed an option agreement to acquire a 100% interest in additional Zinc-Copper claims located in the Red Lake, Ontario region. The 640 hectare (15800 acre) Dixie 3 property is located in northwest Ontario, 45 kilometres southeast of Red Lake and 24 kilometres north of the town of Ear Falls. It is accessible by all-weather forestry access roads. The Dixie 3 property is within 8 kilometres of the Company’s Dixie 17,18, 19, 20 properties and fits within the Company's exploration model.

Dixie 3, formerly known as the Snake Falls property, lies within the Confederation Lake greenstone belt, which is known to host numerous Volcanogenic

Massive Sulphide (VMS) occurrences and deposits. The largest VMS deposit to date, the South Bay Mine, produced, between 1971 and 1981, approximately

354,000,000 pounds of zinc, 57,600,000 pounds of copper and 3,740,000 ounces of silver from 1,600,000 short tons (grades of 11.06% Zn, 1.8% Cu and

72.7 g/t Ag).

The property was explored by Selco in the period 1977-1981, by Noranda between 1989 and 1994, and by Tribute Minerals (now Aurcrest Resources)

between 2002 and 2012. Parts of the present property were explored by Hudson Bay Exploration and Development between 1973 and 1977. A total of

approximate 80 diamond drill holes have been drilled on the property.

The Dixie 3 property hosts the Dixie 3 VMS zone, which was estimated to contain 91,000 short tons grading 1% copper and 10% zinc*. In addition to

the Dixie 3 VMS zone, the property includes a number of mineralized zones or targets with single drill intercepts:

● Breccia Zone, with 3.63% Zn over a core length of 2.0 metres

● Ten Mile Zone, with a 4.0 metre core length of 1.25% Zn and 0.11% Cu

● Dixie South - West Zone, with a 24 metre core length of 0.57% Zn and 0.05% Cu

● Dixie South - Central Zone, with 0.95% Zn over a core length of 18.4 metres

● Dixie South - East Zone, with a 28 metre core length of 0.50% Zn and 0.04% Cu, including 5.2 metres of 1.9% Zn and 0.11% Cu

● South Zone Vent Breccia, with a 37.5 metre core length of anomalous zinc, including 6.5 metres of 1.96% Zn

● Vent Zone, with a 30.5 metre core length of 1.1% Zn and 0.08% Cu.

In 2008, Tribute Minerals carried out a Titan-24 DCIP and MT survey over the Dixie 3 area covering approximately one-sixth of the property. The results of the DCIP were

filed for assessment work, and demonstrated two target areas at depths of between 300 and 600 metres.

Pistol Bay plans to compile the historical diamond drilling and geophysical survey data for the Dixie 3 property, and if possible, to re-acquire and re-evaluate the results

of the 2008 Titan 24 survey. Possible further work includes additional deep-penetration surveys over the remainder of the property and drill testing of new target areas as

well as lateral and depth extensions of known mineralized zones.

* Note: this is a historical resource estimate that does not comply with NI 43-101 and has not been reviewed by a Qualified Person to assess its reliability. It was

presented in a 1992 assessment report by Noranda Exploration, and post-dated all the diamond drilling done on the zone to the present. The method(s) of calculation were

not disclosed. The estimate was called a “mineral inventory”, a term which does not conform to any of the classes of mineral resource or mineral reserve recognized by

NI 43-101. Its relevance is that demonstrates the order-of-magnitude size and grade of the mineralized zone.

Technical material in this news release has been prepared and/or reviewed by Colin Bowdidge, Ph.D., P.Geo., a Qualified Person as defined in National Instrument 43-101.

Under the option agreement, in order to acquire a 100% interest in the Dixie 3 claims, Pistol Bay is required to make total cash payments of $56,000 and issue a total of

2,400,000 shares over a three-year period. The vendors of the Dixie 3 claims will retain a 0.5% net smelter returns royalty, which may be repurchased for $400,000 at

any time up to when a production decision is made. Rubicon Minerals Corp. will also retain a 0.5% net smelter returns royalty.

About Pistol Bay Mining Inc.

Pistol Bay Mining Inc. is a diversified Junior Canadian Mineral Exploration Company with a focus on precious and base metal properties in North America. For additional

information please contact Charles Desjardins – [email protected] - at Pistol Bay Mining Inc.

On Behalf of the Board of Directors

PISTOL BAY MINING INC.

"Charles Desjardins"

Charles Desjardins,

President and Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note:

This report contains forward looking statements. Resource estimates, unless specifically noted, are considered speculative. Any and all other resource or reserve estimates are historical in nature, and should not be relied upon. By their nature, forward looking statements involve risk and uncertainties because they relate to events and depend on factors that will or may occur in the future. Actual results may vary depending upon exploration activities, industry production, commodity demand and pricing, currency exchange rates, and, but not limited to, general economic factors. Cautionary Note to US investors: The U.S. Securities and Exchange Commission specifically prohibits the use of certain terms, such as "reserves" unless such figures are based upon actual production or formation tests and can be shown to be economically and legally producible under existing economic and operating conditions.